Indian stock markets began trading on a cautious note this Wednesday as rising geopolitical tensions between Israel and Iran weighed heavily on investor sentiment. The ongoing conflict, now in its sixth consecutive day, has significantly impacted global market trends, including Indian equities.

As of market opening:

- Nifty 50 opened at 24,797.15, down by 65.05 points or 0.26%.

- BSE Sensex dropped 269 points to start at 81,313.9, reflecting a 0.33% decline.

The immediate trigger for this selloff stems from heightened fears of broader international involvement in the Middle East conflict. Specifically, US President Donald Trump’s recent demand for an “unconditional surrender” from Iran has escalated tensions dramatically. Iran’s outright rejection of this demand has further fueled anxieties, leaving global investors on edge.

Israel-Iran Conflict: A Brief Overview

Israel is reportedly achieving quick military successes in the conflict, with reports suggesting that the country has established air superiority over Iran. However, Iran’s missile capabilities remain a significant threat, leading to a prolonged standoff rather than quick resolution.

What’s more concerning for the global markets is that Iran’s nuclear infrastructure remains largely intact. Despite suffering the loss of important military and scientific figures in the recent attacks, Iran is showing no signs of backing down. The situation has now evolved into a test of endurance between the two nations.

For Indian investors, the major worry revolves around:

- Potential disruption in global oil supply routes.

- Rising crude oil prices impacting India’s current account deficit.

- Foreign institutional investors (FIIs) adopting a risk-off approach.

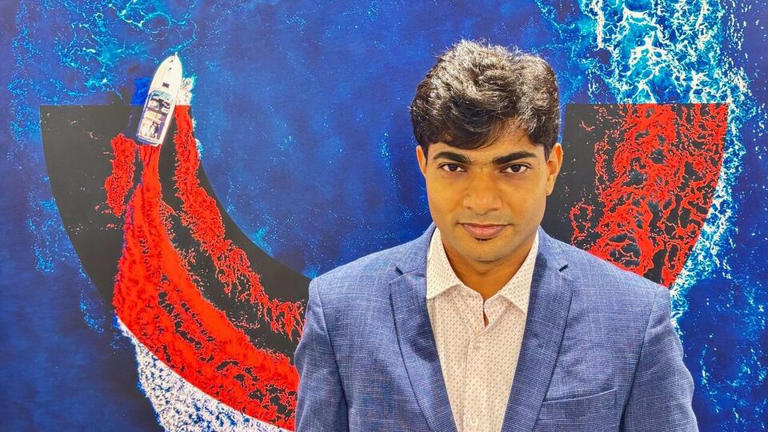

Market Outlook by Sagar Doshi, Nuvama Professional Clients Group

Despite the volatility, experts advise caution, not panic. Sagar Doshi, Senior Vice President – Research at Nuvama Professional Clients Group, provides his technical outlook on the Indian markets:

Nifty 50 Analysis

Nifty has once again entered a consolidation zone, defending its critical support level of 24,650 during last Friday’s session. The index is expected to trade within a range of 24,650 to 25,050 unless there’s a decisive breakout.

Bank Nifty Analysis

Similarly, Bank Nifty remains within its 55,400 – 56,200 range, having successfully held the lower boundary during last week’s close. Any confirmed breakout could propel the index by 1,000 points in either direction.

3 Stocks to Buy Today by Sagar Doshi

In the middle of global volatility, smart stock picking remains the key to portfolio growth. Here are three handpicked stocks recommended by Sagar Doshi for Wednesday’s trading session:

1️⃣ Kaynes Technology India Ltd (BUY)

- Last Closing Price (LCP): ₹5,644

- Stop Loss (SL): ₹5,360

- Target (TGT): ₹6,100

Why Buy?

Kaynes Technology shares are showing early signs of reversal from its 200 DMA after witnessing a 20% correction in the past month. The price action is also aligned with a 50% Fibonacci retracement, suggesting a possible 10-15% rally in the short term.

2️⃣ Mahanagar Gas Ltd (BUY)

- LCP: ₹1,433.50

- SL: ₹1,390

- TGT: ₹1,520

Why Buy?

Mahanagar Gas has achieved a 7-month high closing, breaking above its 200DMA. This indicates the end of a 6-month sideways phase and opens up room for a 6-8% rally in the near future.

3️⃣ Hero MotoCorp Ltd (BUY)

- LCP: ₹4,371

- SL: ₹4,150

- TGT: ₹4,800

Why Buy?

After gaining nearly 30% from its March lows, Hero MotoCorp is now on the verge of breaking out from an inverse head and shoulders pattern. A potential bullish flag breakout is anticipated, with upside potential of 10% from the current market price (CMP).

Air India in Trouble: AI2491 Mumbai-Lucknow Flight Cancelled Amid DGCA Crash Investigation

[…] Stock Picks for Today: Sagar Doshi Recommends Kaynes Technology, Mahanagar Gas & Hero MotoCorp f… […]